Simple Guide to Transfer Cash App to Bank in 2025: Discover Easy Steps!

In today’s digital age, understanding how to transfer Cash App to bank effectively is crucial for managing your finances conveniently. With millions of users relying on the Cash App for various transactions, this guide provides clear steps and insights on using Cash App’s features to complete bank transfers smoothly. Whether you are looking to manage your balance, initiate a cash app withdrawal, or explore settings for linking your bank to the Cash App, this article will walk you through each essential step in 2025.

Understanding Cash App Bank Transfer Options

Cash App offers multiple options for transferring funds to your bank account securely and efficiently. One of the key aspects of using Cash App effectively is making sure you understand the different transfer options available. When you want to extract funds from your Cash App account, you can either choose an instant transfer, which incurs a fee, or a standard transfer that does not involve charges. The standard transfer option can take one to three business days to reflect in your bank account, making it essential to select the best choice based on your needs.

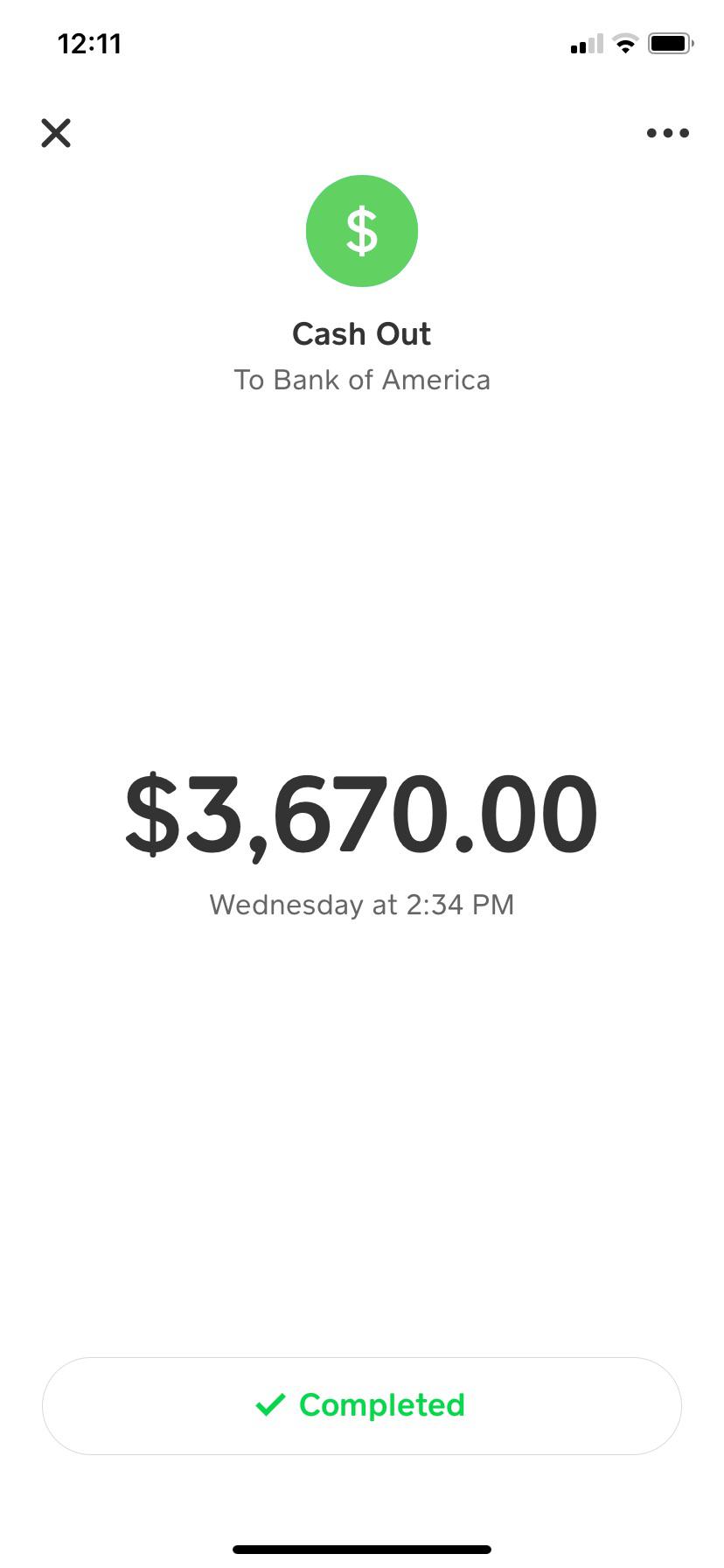

The Cash App Transfer Process Explained

The Cash App transfer process is straightforward. To initiate a transfer, first open your Cash App. Tap on the dollar amount on the home screen, then select “Cash Out.” Here, you can choose between the default 1-3 business day option or the instant transfer. Enter your desired amount and follow the prompts to finalize the transaction. It’s vital to ensure that your Cash App bank information is accurately entered to avoid any delays during the transfer process.

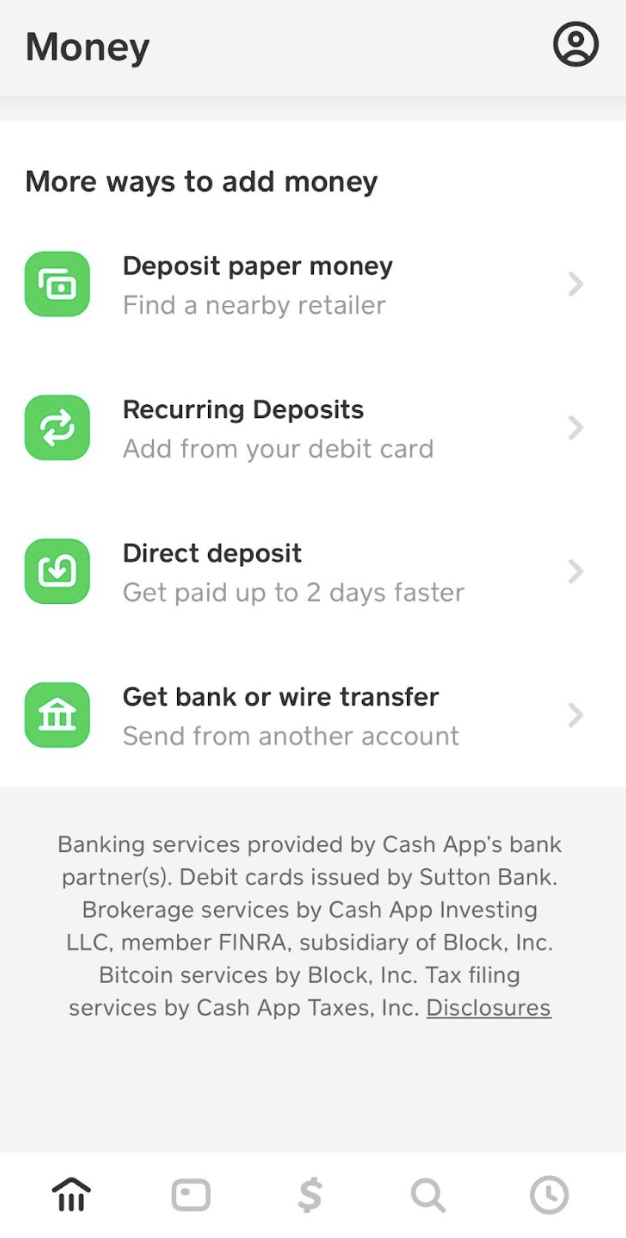

Setting Up Cash App Direct Deposit

For those frequently using Cash App, setting up Cash App direct deposit could be an advantageous feature. To activate this service, navigate to your account settings and find the “Direct Deposit” option. Here, you can enable direct deposits and receive your paycheck directly into your Cash App account, streamlining the process of managing your funds. This method is particularly effective for quick access to cash without leaving your app. Furthermore, by enabling direct deposit, you can use features like instant payments without needing frequent cash app bank transfers.

Cash App Transfer Limits and Fees

Another crucial aspect of utilizing Cash App for bank transactions is understanding its transfer limits and fees. Each account has a cap on the amount you can transfer within a given period. Regular accounts typically have a sending limit of $250 within a 7-day period and a receiving limit of $1,000 within a 30-day window. To maximize your financial transactions, consider verifying your account, as this can significantly raise these limits, allowing for more extensive transactions via Cash App. Additionally, keep an eye out for any associated fees—especially with instant transfers—so you can manage your financial resources effectively.

Linking Your Cash App to a Bank Account

Connecting your Cash App to your bank account forms the backbone of efficiently managing your transactions. The linking Cash App to bank process is relatively simple, but it requires attentive steps to ensure security and accuracy. Begin by heading to your Cash App home screen, tap the profile icon, and then navigate to “Linked Accounts.” From here, you can add your bank account details, such as account number and routing number. This information remains private, and Cash App implements robust security features to safeguard your details.

Verifying Your Bank Account on Cash App

For seamless Cash App bank transfers, it’s essential to verify your bank account connected to the app. During the verification process, Cash App may send small deposits to your bank. You’ll need to confirm those amounts back in the Cash App to complete your verification. This process not only increases security but also enhances your overall application experience, enabling you to use all available Cash App features, including larger transactions—thereby improving your cash app payment methods.

Cash App Bank Integration for Enhanced Security

Cash App’s commitment to security for bank transfers is paramount in promoting user trust. By ensuring that your cash app account is properly linked to a bank and that your account settings are geared toward security, you can secure your transactions against potential fraud. Enable security features like biometrics and set up transaction alerts. Understand that a well-linked Cash App bank account not only improves convenience but also enhances the safety of your financial operations, empowering you to conduct transactions confidently.

Troubleshooting Cash App Transfer Issues

Every user may encounter difficulties with Cash App at some point, so knowing how to troubleshoot these issues is vital for seamless management of your cash app transfer process. Common issues include bank transfer delays, transfer failures, or problems with receiving funds. First, it’s advisable to check your internet connection or overall app functionality. Ensure that you are using the latest version of Cash App as outdated apps often lead to performance issues.

Common Issues with Cash App Transactions

Knowing the common issues with Cash App transfers assists in prompt resolution. If a transaction fails, the funds will typically remain in your Cash App balance, and you will be notified via the app. If funds do not appear within the expected timeframe, check your transaction history for any concerns. It’s also essential to monitor your cash app transaction history, which logs all activities and can provide insights into what might have gone wrong.

Contacting Cash App Customer Service for Support

For persistent issues or if you are unable to resolve transfer concerns through self-help, reaching out to Cash App customer service becomes necessary. They provide tailored assistance based on your situation. You can contact them via the help center on the app or their official website, ensuring you describe your issue clearly for a fast resolution. Additionally, have all relevant information, such as payment receipts at hand, to aid in the support process.

Conclusion and Key Takeaways

In summary, understanding how to effectively transfer Cash App to bank involves multiple factors—ranging from understanding your transfer options and linking your bank account securely, to managing transfer limits and knowing how to address common issues. By utilizing the practical tips and steps provided in this guide, you should find it easier to navigate cash app transfers effectively in 2025. Whether using direct deposit, performing withdrawals, or managing payment methods, you’ll be equipped to maximize your Cash App experience. For any concerns, always consider reaching out to Cash App’s customer service.

FAQ

1. How do I set up Cash App direct bank transfer?

To set up a cash app direct bank transfer, navigate to your Cash App settings and find the direct deposit option. Enter your bank information as requested. Once added, you will receive a confirmation, typically within a few seconds, allowing you to send money directly from your bank account via Cash App.

2. What are the fees associated with sending money from Cash App?

Cash App usually charges a fee of 1.5% for instant withdrawals, while standard transfers that take 1-3 business days are free. Always be sure to review your transfer options to avoid unnecessary charges.

3. Why is my Cash App transfer pending?

A pending cash app transfer may be due to connectivity issues, unverified accounts, or if the payment method is not accepted. Additionally, ensure that you are not exceeding your daily transfer limits. If the issue persists, check the Cash App support for assistance.

4. Can I link multiple bank accounts to Cash App?

Yes, you can link multiple bank accounts to your Cash App account, but only one can be set as the primary withdrawal account. To link a new account, choose “Linked Accounts” in your settings and add the desired bank information.

5. What should I do if I have trouble verifying my bank account?

If you’re experiencing issues verifying your bank account on Cash App, ensure that you’ve correctly entered your account number and routing number. If you continue facing difficulty, reach out to Cash App support promptly for further guidance.