Effective Ways to Calculate Growth Rate for Your Business in 2025

Understanding how to accurately calculate growth rate is crucial for businesses aiming to evolve and strategize effectively in the coming years. In 2025, employing precise growth metrics can help assess a company’s trajectory and identify opportunities for improvement. This article covers various techniques to determine the growth rate while emphasizing the most relevant formulas and practical implementations across different sectors.

Understanding the Growth Rate Formulas

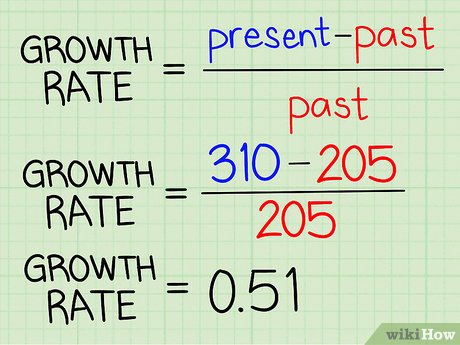

The journey to calculate growth starts with understanding the basic growth rate formula. The formula can be simplified to: (Ending Value – Starting Value) / Starting Value × 100. This approach can help businesses and analysts assess performance over specific periods.

Annual Growth Rate Calculation

The annual growth rate provides insights into business health over a year. To find this, you can use the formula: ((Ending Value / Starting Value)^(1/n)) – 1, where n equals the number of years. For example, if your company earned $200,000 in 2020 and increased to $250,000 in 2023, you would apply this formula to find the average yearly growth rate over three years. This method is particularly useful for understanding business growth rate across multiple fiscal periods.

Compound Growth Rate Insights

Compound growth rate offers an extended perspective on growth over several periods, compounding year-on-year gains. The formula can be expressed as: ((Ending Value / Beginning Value)^(1/n)) – 1, which is critical for understanding the cumulative results of investments. For instance, if an investment grows from $10,000 to $15,000 over three years, using this method lets get a more generous view of the investment’s performance, especially when evaluating:investment growth rate strategies. The ability to grasp this concept improves an organization’s growth rate analysis capabilities.

Key Factors Affecting Growth Rate

There are myriad factors affecting the economic growth rate indicators for businesses. Various elements like industry trends, economic conditions, and competition play significant roles in shaping an organization’s growth potential. Identifying these factors can aid businesses in refining their strategies for long-term success.

Market Analysis for Growth Rate Trends

Market trends represent a significant piece of the puzzle in understanding your sales growth rate. To assess these trends, consider leveraging industry reports or utilizing specialized tools for marketing analytics that cover historical growth rates and project future trajectories. For instance, investigating the fluctuations in the technology sector can illuminate potential growth trajectories for tech startups or established IT firms alike.

Growth Rate Comparison across Sectors

Conducting a comprehensive growth rate comparison between same-industry players can furnish you with insightful benchmarks for evaluating company performance. Apply the same methods of calculating growth to similar businesses to see where your company stands. For example, if your company reports a revenue growth rate of 10% while competitors are at 15%, it could signal underlying issues that need addressing. Hence, consistent adjustments based on comparative measures can lead to improvements.

Practical Steps in Growth Rate Calculation

Implementing effective strategies in measuring growth rate metrics ensures accuracy in representing how well a business performs over time. Following systematic calculation steps and refining methodologies can yield valuable insights into future performance.

Growth Rate Calculation Steps

To accurately calculate your business’s growth, follow these steps:

1. Determine the period of analysis (e.g., monthly, quarterly, or annually).

2. Collect reliable data for both end and start values.

3. Apply the growth rate formula with the gathered data.

4. Review historical growth rates for potential insights.

5. Implement the calculations to make informed adjustments in your strategies.

By utilizing a proper estimation approach, businesses can harness this algorithmic model to support strategic review sessions, making it a robust feature of growth rate operations.

Utilizing Technology in Growth Rate Metrics

The advent of technology has introduced various tools that can simplify growth rate calculation. Financial software can track income, expenses, and revenue growth, making it easier to visualize financial health and accelerate analysis. These applications often provide real-time data, allowing businesses to make informed decisions expediently, ultimately paving the way for systematic and informed growth rate trends.

The Implications of Growth Rate Calculations

Understanding the implications of your calculated growth rate is essential for effective business strategy. These calculations not only identify current performance but also reveal areas for potential expansion or contraction in operations. Additionally, observing historical patterns and economic growth indicators can provide a clearer picture of what influences growth.

Interpreting Growth Rate Data

Interpreting the factors that impact growth rates requires scrutiny of various economic indicators and how they relate to business performance. For instance, economic conditions such as GDP fluctuations could directly influence your projected GDP growth rate. Therefore, aligning your growth strategies against these trends ensures adaptive capabilities in shifting market landscapes while safeguarding your organization from possible downturns or losses.

Growth Rate Adjustments for Future Success

Analyzing your growth rate metrics can help navigate future business paths. For example, should results show consistent poor performance, it might necessitate restructuring product offerings or revisiting marketing strategies. Keeping an ongoing assessment of growth-related data ensures readiness to pivot operations as required, yielding greater profitability and sustainability over time.

Key Takeaways

- Understanding how to calculate the growth rate provides vital insights for business strategy.

- Recognizing different formulas, such as the annual and compound growth rates, can yield deeper analyses.

- Focusing on key factors affecting growth will facilitate better foresight into business performance.

- Utilizing technology and software can enhance the accuracy and efficiency of growth rate calculations.

- Systematic review and adjustments based on growth data are crucial for sustainable success.

FAQ

1. How can I find growth rate for my business over the years?

To find the growth rate, utilize the formula (Ending Value – Starting Value) / Starting Value × 100 over your desired period. Collect yearly data, apply the formula, and compare the results for an annual assessment. Consistent analysis of growth metrics enables your company to adapt to evolving market dynamics and better forecast future trends.

2. What are the key factors that influence growth rates in different industries?

Factors influencing growth rates can include economic conditions, competitive landscape, technological advancements, and consumer behaviors. By understanding these elements, companies can align their strategies with market trends and make informed decisions regarding operational expansions or contractions.

3. How is the GDP growth rate calculated and why is it important?

The GDP growth rate is typically calculated as the percentage increase in a country’s GDP over a specific period, reflecting the economic health of a nation. It’s essential as it influences investment decisions, government policies, and overall market movements that can affect business performance in various sectors.

4. What is the significance of comparing growth rates?

Comparing growth rates among competitors offers benchmarks for assessing operational success. By understanding where your organization stands relative to industry performance, you can address weaknesses and capitalize on strengths through strategic adjustments.

5. Can technology aid in tracking my business’s growth rate?

Yes, technology plays a crucial role in tracking and analyzing growth rates through various software solutions that allow real-time data gathering and visualization. This facilitates timely decision-making as companies can swiftly assess their performance trajectory.

6. What types of growth rates should my business monitor regularly?

Your business should regularly monitor metrics like sales growth rate, revenue growth rate, and annual growth rate. By concentrating on these areas, you can develop a comprehensive view of overall performance, allowing you to tailor strategic initiatives effectively.

7. How do historical growth rates aid in planning for future growth?

Historical growth rates provide a baseline analysis that helps identify trends over time, guiding forecasting efforts for future strategies. They can pinpoint patterns in growth acceleration or deceleration, allowing companies to adjust their strategic planning accordingly for better outcomes.