“`html

Practical Ways to Remove Paid Collections from Your Credit Report in 2025

If you’ve been dealing with paid collections on your credit report, you’re not alone. Many individuals are eager to improve their credit scores by removing these entries. In 2025, there are practical means of pushing these negative items towards deletion while ensuring you’re utilizing all your rights as a consumer. This article will explore actionable strategies that you can implement to remove paid collections effectively, enhance your credit profile, and establish a healthier financial future.

Understanding Your Credit Report and Consumer Rights

Before taking measures to remove paid collections, it’s essential to understand how credit reports function and the laws protecting you. Your credit report is a comprehensive document that outlines your credit history, including any negotiated debt settlements or lapse in payments that could damage your credit score. Under the Fair Debt Collection Practices Act, consumers possess certain rights that help safeguard them from unfair credit practices. Understanding these rights is crucial when dealing with collection agencies.

The Role of Credit Reporting Agencies

Credit reporting agencies play a pivotal role in how collections are reported and influence your credit score. There are three major agencies: Experian, TransUnion, and Equifax, and they compile data based on your financial activities. Once a debt has been paid, it may still reflect negatively on your credit report; thus, knowing how these agencies operate can aid in developing your credit repair strategies. Consider requesting updated reports to verify that paid collections are accurately reflected.

Consumer Rights and Credit Reporting Laws

It’s crucial to be aware of the consumer rights established under federal and state laws. These include the right to dispute inaccurate information and the right to request corrections. If a debt validation request reveals inaccuracies, you can take the necessary steps to rectify them. By leveraging your rights, you can enforce credit report corrections that will support your effort to improve your credit health.

Strategies for Removing Paid Collections

Once you have a firm grasp on your credit report and consumer rights, the next step is to embrace collection removal techniques. These strategies will often necessitate direct communication with collection agencies and potentially using formal dispute letters.

Negotiating with Collection Agencies

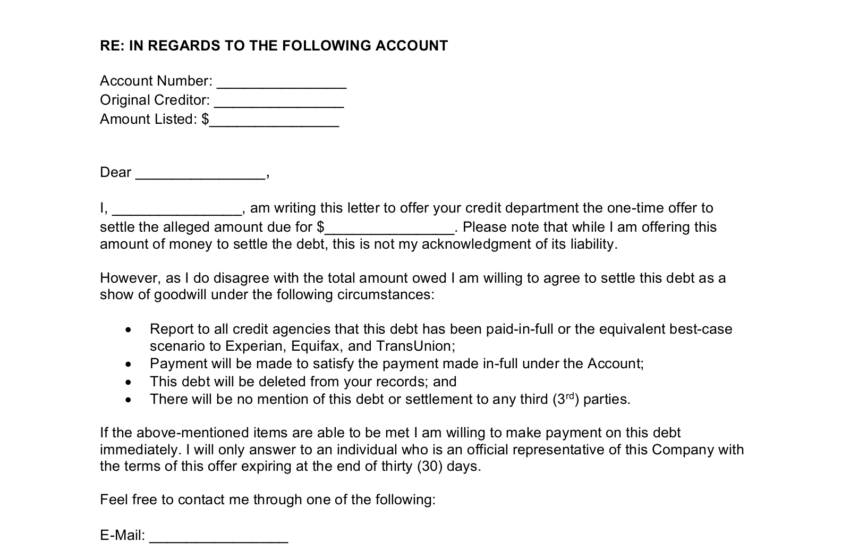

Many consumers have successfully used negotiation tactics to mitigate the impact of collections on their credit reports. When you negotiate with collectors, aim for a pay for delete agreement, where the lender removes the negative entry from your credit report in exchange for payment. This agreement not only aids in removing collections accounts but can significantly facilitate credit score improvement.

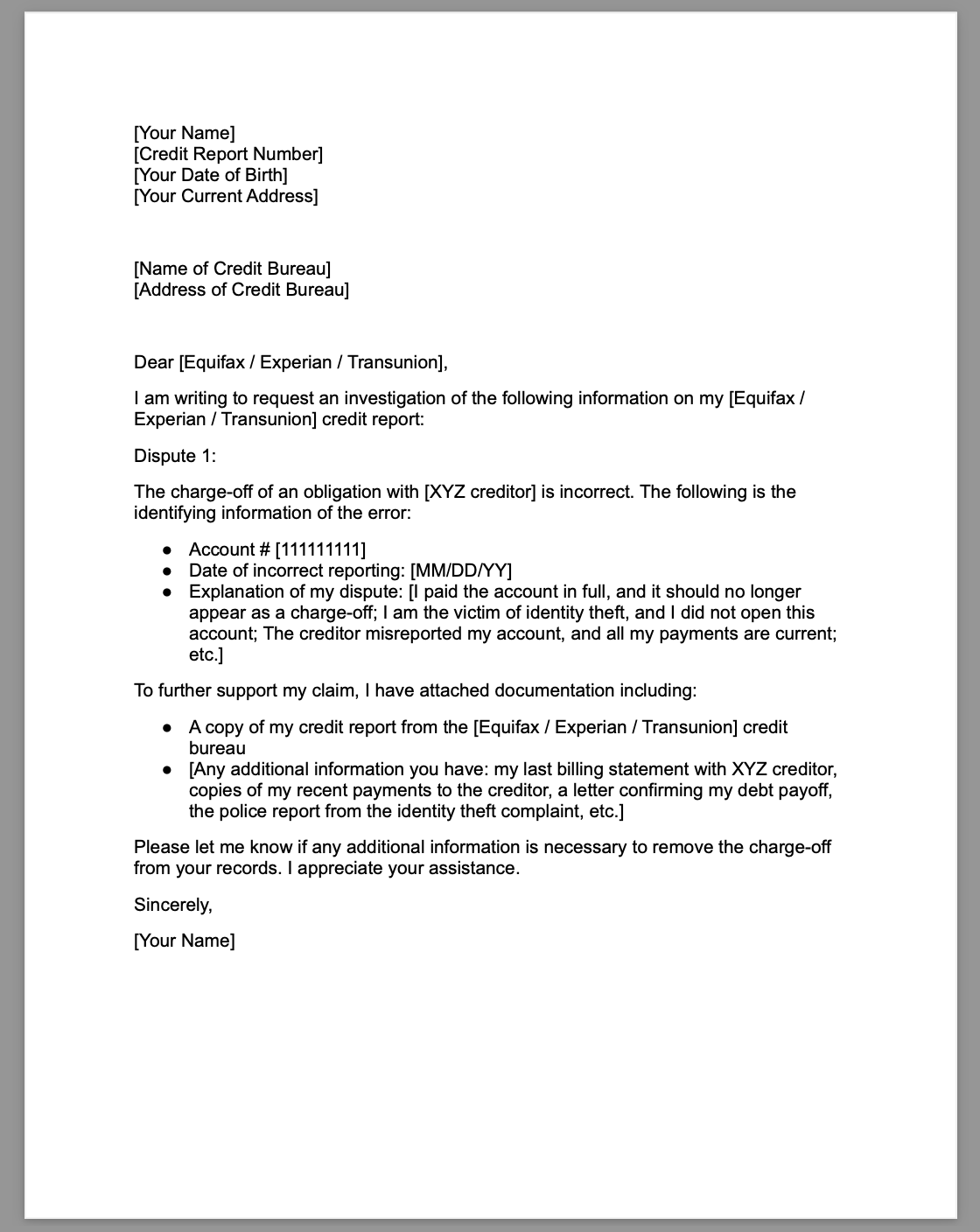

Dispute Process for Collection Listings

Disputing collection account listings is another avenue worth considering. When initiating a dispute, be sure to gather evidence such as payment receipts, which can substantiate your claims. Utilize clear, concise language in your writing dispute letters, addressing the inaccuracies directly. You can send these letters to both the credit reporting agencies and the collection agency to start the process of removing negative items.

Proactive Credit Report Maintenance

Once actions to remove paid collections have been taken, it’s crucial to maintain ongoing credit report accuracy. Acknowledge that long-term management of your credit health relies greatly on your financial habits.

Monitoring Your Credit Report Regularly

One proactive measure can be to invest in credit monitoring services, which can alert you to any changes or inaccuracies as soon as they occur. Regular monitoring allows for swift action, whether that involves disputing inaccuracies or checking for new credit report errors that could impede your credit score recovery journey.

Integrating Credit Educations into Your Financial Practices

Incorporating financial literacy into your lifestyle enhances your understanding of credit score factors and improves your chances of maintaining good credit moving forward. Engaging in credit counseling services or financial education programs can provide valuable tools to manage debts effectively and help maximize your credit score.

Key Takeaways

- Understand your rights as a consumer concerning credit reporting.

- Utilize negotiation techniques to open dialogues with collection agencies.

- Dispute inaccurate entries with proper documentation and effective letters.

- Monitor your credit regularly for errors and inaccuracies.

- Commit to ongoing financial education and management strategies.

FAQ

1. What is a pay for delete agreement?

A pay for delete agreement is an arrangement where a debtor agrees to pay a owed amount, and in return, the creditor removes the paid collections from the credit report. This agreement can effectively enhance a consumer’s credit profile.

2. How can I file a dispute against a collection account?

To file a dispute, gather evidence like payment receipts or statements, and submit a written dispute letter addressing the inaccuracies directly to credit reporting agencies and the collection agency involved. Ensure you keep copies for your records.

3. What are the negative effects of collections on my credit score?

Collections can significantly lower your credit score, impacting your ability to obtain loans, credit cards, or favorable interest rates. The longer a collection item remains on your credit report, the deeper its negative impact.

4. How long do paid collections stay on a credit report?

Typically, paid collections stay on your credit report for up to seven years from the date of the first delinquency. However, utilizing the above strategies may help expedite their removal.

5. Can I use credit repair services to remove collections?

Yes, credit repair services can assist in credit report repair by working on your behalf to dispute inaccuracies and improve credit standing. Ensure that you choose reputable services that adhere to consumer laws.

“`