Effective Guide to Making an ACH Payment

Understanding the ACH Payment Process

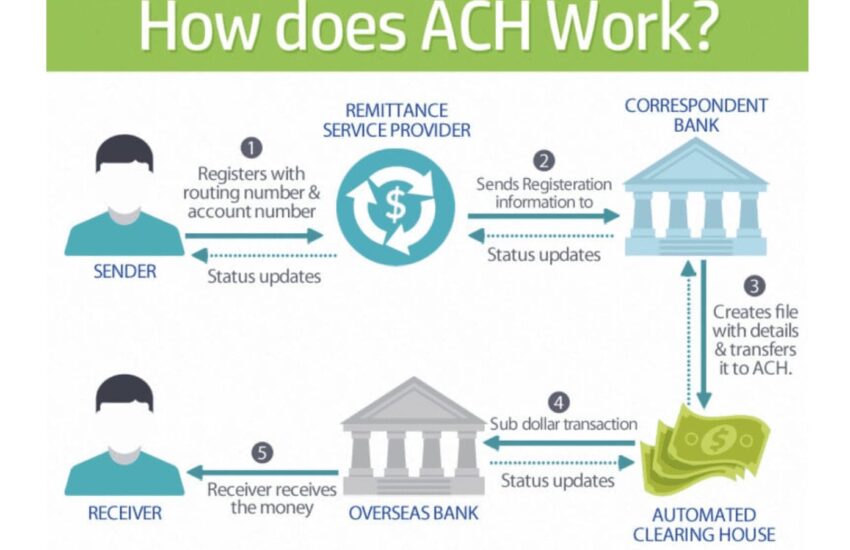

The **ACH payment process** involves the movement of funds from one bank account to another through an Electronic Funds Transfer (EFT) system. The Automated Clearing House (ACH) network facilitates both **ACH debit transactions** and **ACH credit transactions**. One of the primary benefits of using ACH payment methods is the efficiency and safety they provide. By adopting **ACH electronic payment** solutions, businesses can streamline their payment operations. The ability to integrate **ACH payment platforms** with existing accounting systems enhances cash flow management, reduces processing fees, and minimizes the risk of fraud. As we delve deeper into this guide, we’ll explore the essential steps to make an ACH payment in 2025.

How to Make an ACH Payment

To begin with the **ACH payment setup**, users must first ensure they take the necessary ACH payment initiation steps. The fundamental requirements involve providing accurate bank account information, including the bank routing number and account number. Here’s a step-by-step breakdown:

- Gather your banking information: Ensure you have your account balance, routing number, and any other necessary details.

- Select a payment platform: Use an ACH payment app or service that suits your financial needs.

- Initiate the transfer: Fill in the required details in the platform, including the amount to be paid and any identifiable references.

- Authorize the transaction: Commonly, this involves clicking a button or confirming through an email.

Following these steps will set you on the right path toward executing a successful ACH transfer.

ACH Payment Authorization and Security

Another crucial aspect is **ACH payment authorization**, which protects both parties involved in a transaction. Businesses must ensure that they obtain the consent of their customers before initiating any ACH payment; this measure effectively enhances **ACH payment security**. In addition, processing organizations often utilize multiple layers of verification, such as identity confirmation and transaction alerts, to prevent unauthorized access and protect sensitive account information. Proper protocols stand as guarantees against fraudulent activity and ensure customer peace of mind.

The Importance of ACH Payment Confirmation

After initiating an ACH payment, it’s essential to track the **ACH payment confirmation** process. This involves assuring that the payment has been processed successfully and has been credited to the recipient’s account. Most ACH payment services provide receipt options, detailing transaction dates and amounts cleared. By maintaining **ACH payment receipts**, individuals and businesses can perform easier reconciliations, ensuring accurate accounting records.

Benefits of ACH Payments

Utilizing **ACH payment methods** is associated with various advantages that can substantially impact business operations and client relationships. The primary benefits include cost-effectiveness, efficiency, and reliability in cash flow management. **ACH payment processing time** often presents a far quicker and cheaper alternative to traditional checks, which can take several business days. Furthermore, ACH payments come with lower transaction fees compared to credit card payments, ultimately translating to enhanced bottom lines.

Cost Savings Associated with ACH Transactions

Switching to **ACH payment processing** often results in significant cost savings for businesses. ACH fees per transaction are considerably lower than credit or debit card processing fees. For example, while card transactions can incur fees between 1% to 3% plus per-transaction costs, ACH payment fees typically fall around $0.25 to $1.00 per transaction. Implementing this kind of payment methodology can yield substantial savings over time, especially for companies managing a high volume of transactions.

The Flexibility of ACH Payment Scheduling

Another aspect of **ACH payment scheduling** allows businesses to set recurring payments, benefiting both the payer and payee. Setting up automatic payments (whether for payroll or vendor invoices) can significantly enhance productivity and ensure timely payments without manual intervention. This way, payments are never missed, directly impacting vendor relationships and improving creditworthiness.

Efficient ACH Payment Management

Furthermore, businesses engaged in managing their finances often utilize **ACH payment management** tools that facilitate supervision and tracking of all transactions. This ensures that all payments are accounted for and allows organizations to take control of their cash flow. Real-time access to **ACH payment tracking** tools provides businesses the ability to monitor transactions, troubleshoot discrepancies, and quickly address any potential issues with delay or lost payments. This proactive approach aids in reconciliations and financial planning.

ACH Payment Troubleshooting and Assistance

Despite the overall effectiveness of the ACH payment system, there are instances where issues may arise. Familiarizing oneself with common **ACH payment troubleshooting** tips can help users quickly resolve issues before they escalate, saving valuable time and resources.

Common Issues and Solutions for ACH Payments

Common mistakes include input errors while entering either the recipient’s bank account details or payment amounts, which can lead to rejected transactions or lost funds. Users should verify all information prior to submitting any ACH payment. Additionally, if a transaction gets declined due to insufficient funds, monitoring should be intensive until the issue is corrected. Meanwhile, poorly integrated systems often lead to errors; therefore, businesses should ensure that their **ACH payment integration** methodologies comply with industry standards to avoid complications.

Finding ACH Payment Assistance Resources

If challenges persist, there are ample **ACH payment assistance resources** available to users, including online forums, customer service numbers, and helpdesks offered by payment processors. Most services provide dedicated customer service representatives who can help resolve issues and answer any related inquiries. These resources enhance the overall user experience, allowing for efficient troubleshooting.

ACH Payment Compliance Standards

Adhering to **ACH payment compliance** standards is crucial for avoiding fiduciary mishaps and maintaining developer-client trust. ACH mandates regularly update to reflect the industry landscape; hence, staying up-to-date on regulations ensures a sound operational flow. Organizations can leverage the guidance provided by compliance specialists and resources to develop sound ACH payment policies tailored for their operations.

Key Takeaways

- Understanding the **ACH payment process** helps streamline electronic transactions.

- Efficient **ACH payment setup** is critical for swift payment initiation.

- Regular **ACH payment verification** enhances transaction security and reliability.

- Cost-effective transactions through **ACH payment methods** can improve overall financial health.

- Utilizing **ACH payment assistance resources** ensures smoother operations and effective troubleshooting.

FAQ

1. What are the general requirements for setting up ACH payments?

To set up ACH payments, you need to provide your bank account number, the routing number of your bank, and configuration settings on whichever **ACH payment platform** you plan to use. Ensuring accurate input of this information is vital for successful transactions.

2. Are there any fees associated with ACH payments?

Yes, while **ACH payment fees** are typically significantly lower than credit card fees, inspecting your provider’s terms is essential to understanding the specific costs involved. Most ACH processes charge a small flat fee per transaction, necessary to factor into your budgeting.

3. How long does it take for an ACH payment to process?

The **ACH payment processing time** can range from one to three business days, depending on the transaction type and specific banking institutions involved. However, the average duration is often around the 24-hour mark.

4. What should I do if my ACH payment has failed?

If your **ACH payment has failed**, the first step is to verify the entered information for any errors. If it checks out, reach out to your payment service provider to understand the cause of the failure; they can provide specific troubleshooting insights and resolution options.

5. How secure are ACH payments compared to other payment methods?

**ACH payment security** measures protect against unauthorized transactions and fraud. While no digital payment method is entirely risk-free, ACH payments use industry standards such as encryption and multi-factor authentication to mitigate risks effectively.

6. What are some helpful resources for ACH payment users?

There are numerous helpful resources available online, including user guides, FAQs from ACH payment processing companies, community forums, and dedicated customer support services designed to help users understand and handle their ACH transactions effectively.

7. Can businesses automate ACH payments?

Absolutely, businesses can automate **ACH payment processing** through scheduling features in their ACH payment services, allowing for seamless and timely transactions without the need for manual input each time a payment is due.